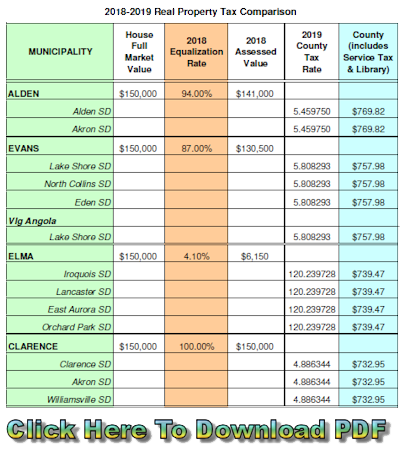

When discussing taxes, politicians & bureaucrats use the word “fairness”. The big question: Is the real property equalization formula used to calculate county taxes fair to Evans taxpayers?

When discussing taxes, politicians & bureaucrats use the word “fairness”. The big question: Is the real property equalization formula used to calculate county taxes fair to Evans taxpayers?

Here is the issue. The NYS formula ONLY uses the highest real estate sales which are mostly lakefronts selling for $1 Million plus. If you live away from the waterfront, these sales are not representative of property values in your neighborhood.

Is the states real property equalization formula flawed? I do not have a PHD in math but my nephew does! Here is his response to this question.

Hi Uncle Ed,

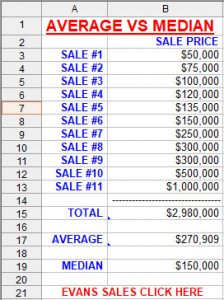

What I can say is that we teach students in every intro statistics class that the average of a data sets is a poor representation of a typical value in a population when there are extreme values (outliers) in the data. In those cases, the average is biased toward the extreme values (high sale prices in your question), and the median is a much better representation of the center of the distribution.

To address you last question, I would have to agree that there is no reason not to use all of the property sales data from the last several years (including factors like lakefront, which is especially relevant for the Town of Evans and many other towns in Western NY). It would not be hard to use those statistics to make well-educated assessment adjustments.

All you need is someone who understands statistical models to write an algorithm that analyzes the historical data, and then it is just a matter of plugging in the information for specific properties to calculate an assessment adjustment. My guess is that the statistical model used does not even need to be very complicated (a generalized version of linear regression is where I would start).

Hope this helps.

Best,

Joshua

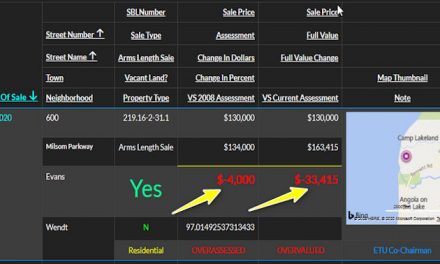

NYS does not use the “average” or “median” sale but cherry picks the highest sales making results even more biased. After calculating an “equalization rate”, why are county taxes ( on a $150,000 property) still not equal?

This information was given to the Evans Town Board. Question #2: Why isn’t the Evans Town Board fighting for Evans Taxpayers?

In a town that often takes its tin cup to Albany, maybe they just do not want to rock the boat?

Since January 1st, 2019, the estimated sale price in Evans was about $179,085. These sales include commercial properties. Beginning January 1st, 2020, sales will include a vacant land / residential / commercial designation.

Removing two commercial sales over $1 million ($2,405,000 & $3,000,000) reduces the average sale to $149,222!

[ Click Here ]

In this example, there are 11 sales. To calculate average, you total the 11 sales then divide by 11 to get the “average”. ($270,909)

In this example, sale #6 is the “median” or middle sale. ($150,000)

When the state uses just the highest priced sales, you can see how the results can be biased.